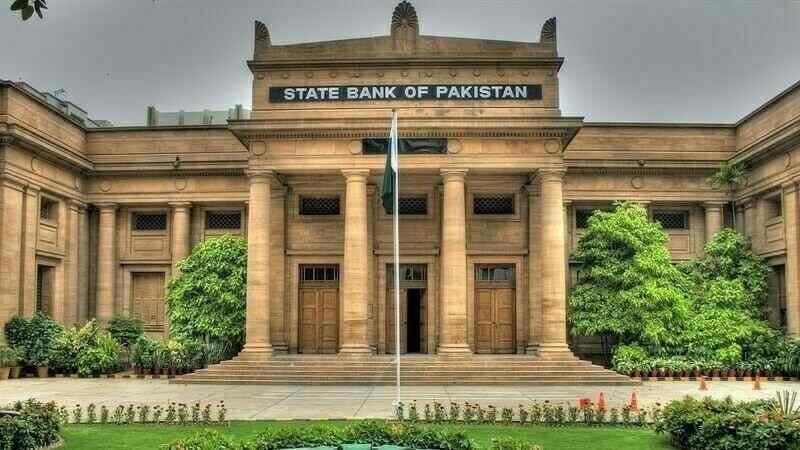

Pakistan’s foreign exchange reserves hit $14.5 billion by June 2025, driven largely by aggressive dollar buying from the State Bank of Pakistan (SBP). The central bank disclosed that it purchased $7.8 billion from the open market over the past year, a move designed to shore up reserves and stabilize the currency.

Briefing the National Assembly’s finance committee, SBP Deputy Governor Dr. Inayat Husain said these interventions were meant to absorb excess liquidity and prevent the rupee from appreciating too sharply—a scenario that could have made imports cheaper but hurt exporters.

“By building reserves, Pakistan can meet its external obligations without leaning on fresh foreign borrowing,” Dr. Husain said, while acknowledging recent currency pressures tied to a widening current account deficit. He added that joint policy actions by the government and SBP have already started easing those pressures.

The deputy governor also said the rupee’s value remains “fair” based on the Real Effective Exchange Rate (REER) model, but future exchange rate movements will hinge on capital inflows and market sentiment.

Cautious Monetary Policy Stance Amid Inflation Concerns

Despite calls for deeper rate cuts to stimulate growth, the SBP is keeping its policy rate at 11%. Dr. Husain defended the central bank’s cautious approach, noting Pakistan’s history of economic boom-bust cycles.

While headline inflation currently stands at 4% and core inflation at 7.4%, he warned of potential upward pressure from global energy prices, rising wheat costs, and new domestic taxes. Inflation is projected to remain within the central bank’s 5–7% target band over the medium term, but short-term spikes are likely.

Focus on Resilience Over Rapid Growth

Pakistan’s current reserves cover 2.3 months of imports, with the SBP aiming to extend that to at least three months to cushion against external shocks.

“Growth will remain measured,” Dr. Husain said, emphasizing that stability and resilience take precedence over rapid expansion. Strengthening reserves, he argued, is key to reducing vulnerability in a global environment marked by volatile commodity prices and uncertain capital flows.